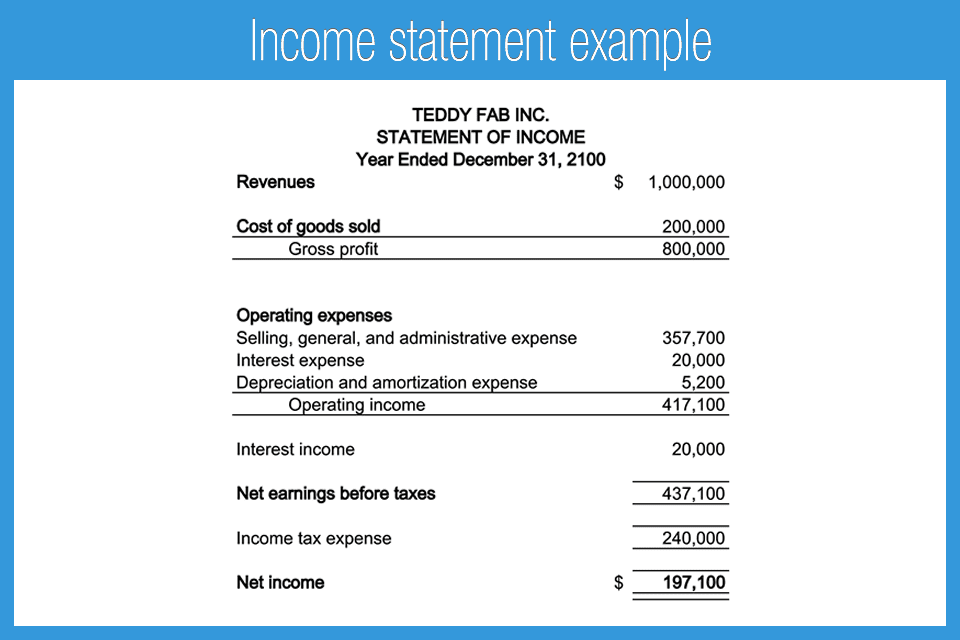

Monthly, quarterly, and annual reporting periods are all common. Your reporting period is the specific timeframe the income statement covers. Related: 13 Financial Performance Measures Managers Should Monitor Steps to Prepare an Income Statement 1. EBITDA: Earnings before interest, depreciation, taxes, and amortization.Depreciation: Value lost by assets, such as inventory, equipment, and property, over time.Earnings per share (EPS): Net income divided by the total number of outstanding shares.

It can also be referred to as a profit and loss (P&L) statement and is typically prepared quarterly or annually. DOWNLOAD NOWĪn income statement is a financial report detailing a company’s income and expenses over a reporting period. Here’s an overview of the information found in an income statement, along with a step-by-step look at the process of preparing one for your organization.įree E-Book: A Manager's Guide to Finance & AccountingĪccess your free e-book today. Being able to read an income statement is important, but knowing how to generate one is just as critical. This document communicates a wealth of information to those reading it-from key executives and stakeholders to investors and employees. The income statement is one of the most important financial statements because it details a company’s income and expenses over a specific period. When it comes to financial statements, each communicates specific information and is needed in different contexts to understand a company’s financial health.

0 kommentar(er)

0 kommentar(er)